Latest News

Read our latest legal and tax news.

April 30, 2024: Deadline to submit your report on last year’s commercial payments.

30 April 2024 is the deadline for preparing a report on payment terms in commercial transactions for 2023. Taxpayers other than tax capital groups who meet all the following conditions are obliged to submit the report: the value of revenue

Real estate tax for 2024 – changes and challenges

The ambiguity of the provisions regarding real estate tax and numerous court and administrative disputes arising on this basis have accustomed us to the fact that each year is decisive for this tax. So, what new things await us in

New obligations for CIT taxpayers – JPK CIT is coming!

CIT taxpayers will soon be obliged to send their accounting books to tax authorities in a form based on the current JPK-KR (so-called JPK-CIT). Taxpayers will be obliged to send data without a request, together with their annual tax return.

End of zero VAT on food

The Ministry of Finance announced on 12 March that the zero rate of VAT on certain food products will not be extended. Which means a return to a 5% VAT rate on basic foods. The Ministry of Finance justifies its

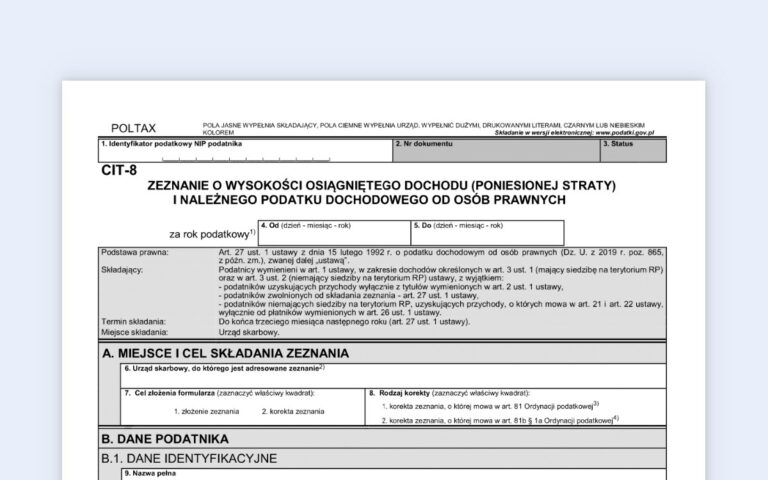

CIT for 2023. Unclear regulations on reliefs

Entrepreneurs whose tax year coincides with the calendar year have only a few days left to settle CIT for 2023 (Tuesday, April 2, is the last day to submit the CIT-8 or CIT-8AB return). There will be no rescheduling this

Fewer taxpayers will benefit from the 9% CIT rate

In 2024, current revenues cannot exceed 8 687 000 PLN so that a lower corporate income tax rate can be applied. This is just one of the requirements for using 9% CIT rate. The second one refers to the previous year’s

Tax Alert – Postponement of Poland’s National e-Invoice System (KSEF)

Ministry of Finance announced that the planned mandatory introduction of the National e-Invoice System (KSeF) from July 1, 2024, has been postponed to a later date. This decision was made following the recommendations of an external IT audit. The Ministry

Minimum CIT is now already in force

From 1 January 2024, the provisions on minimum income tax, contained in Art. 24ca of the CIT Act. It is worth mentioning that the minimum tax was introduced into the CIT Act on 1 January 2022 as part of the

Changes in CIT in 2024

December is a good time to discuss and summarize the tax changes coming next year. What can we expect? Below we present the most important changes in corporate income tax that companies will face in 2024. Minimum tax –

KSeF failure – what to do if it occurs?

From 1 July 2024, in principle, the National e-Invoice System (KSeF) will be mandatory. The date of issue of the e-invoice is the date of its sending to KSeF. The Ministry of Finance ensures that the servers will be prepared

EC economic forecast: Poland will experience economic acceleration

The European Commission forecasts that after the slowdown in 2023, the Polish economy will rebound in 2024 and 2025. Accelerating GDP growth The EC predicts real GDP growth of 0.4% in 2023, 2.7% in 2024 and 3.2% in 2025

The provisions on JPK_VAT will be adapted to KSeF

The Ministry of Finance has submitted for consultation a draft amendment to the regulation regarding the detailed scope of data contained in tax returns and VAT records. The proposed changes relate to JPK_VAT and the introduction of mandatory e-invoicing within

E-Tax Office – the digital revolution.

The new version of the e-Tax Office is now available to taxpayers – both individuals and entrepreneurs. The E-Tax Office system eliminates the need to handle paper documents and facilitates communication with tax offices. The biggest advantage of the new

The minimum wage will increase in 2024

The Council of Ministers adopted a regulation increasing the minimum wage from January 2024. The minimum wage will increase from the current PLN 3600 to PLN 4242, and the minimum hourly rate will increase from PLN 23.50 to PLN 27.70.

Minimum tax – what you need to know.

On January 1, 2024, the suspension of the minimum income tax regulations, wildly known as the loss tax, will end. Minimum taxpayers The minimum tax will apply to taxpayers who in a given year recognized a tax loss or

KSEF – obligations from July 2024.

Pursuant to the Act of June 16, 2023 amending the Act on tax on goods and services and certain other acts, all invoices for business entities will be issued and received in electronic form in a specific structure via the

Increase of tax audits and their effectiveness

After the Covid-19 pandemic ended, the tax office increased the number of tax audits. Based on the statistics provided by the Ministry of Finance and the answers provided on July 5 this year to the parliamentary question no. 41754 and

Return of reporting of domestic tax schemes

Due to the regulation canceling the state of epidemic emergency, the obligation to report national tax schemes (MDR) on time has returned from 1 August 2023. Some taxpayers will have to report overdue MDRs for the last three years. However,

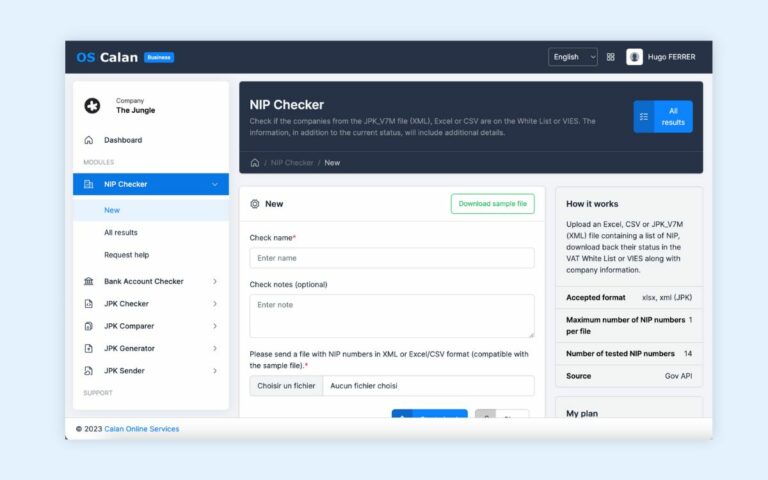

Calan OS – NIP Checker module

From 1 September 2019, provisions regarding the list of VAT taxpayers, i.e. the so-called white list are enforceable. Verification of the data contained in the White List is important from the perspective of tax risk management, and payment to the

DAC7 Directive – new obligations for operators of digital platforms

Currently, consultations are underway on the provisions implementing the DAC7 Directive, imposing a new obligation on digital platform operators to provide tax authorities with information about sellers using the platform. The amendment to the Act amending the Act on the

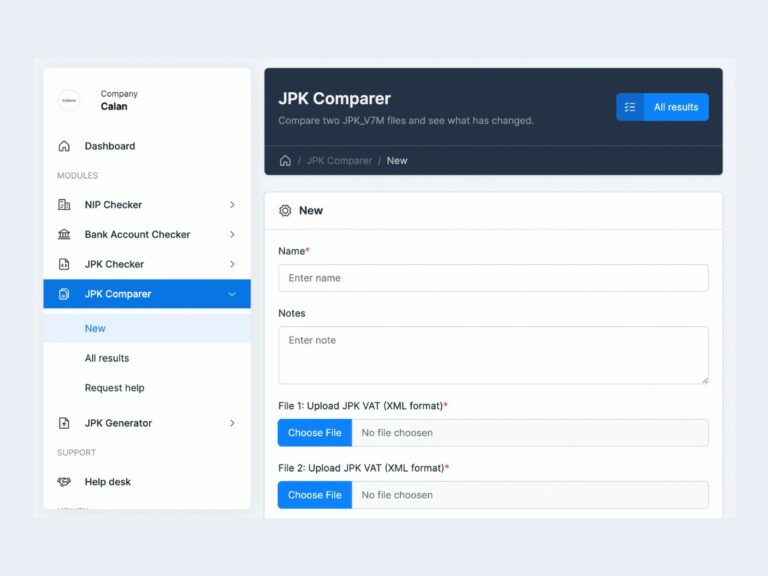

Calan OS – JPK Checker module

We offer our clients a module that allows you to verify the JPK VAT file and identify any technical or substantive irregularities by the taxpayer with a few clicks. JPK Checker is a tool developed by our specialists, conducting several

Cancellation of the state of epidemic threat – tax consequences

At the end of June, the government wants to cancel the state of emergency related to COVID-19. The consequence of this will be the introduction of changes in some tax regulations from 1 July 2023. Residence certificates The changes

Companies will not receive extra money to purchase remote work equipment

New provisions of the Labor Code regulating remote work have been in force since April. Therefore, the enterprises were to receive money to equip employees. However, as part of the revision of the National Recovery Plan, the government intends to

Implementation of new regulations on remote work – obligations of employers

Remote work has been regulated in the Labor Code since April this year. The new regulations impose a lot of obligations on employers who will have to face many challenges. Below are the most important obligations that employers must comply

E-receipt – what is it?

E-receipt is a modern solution with numerous advantages. The entrepreneur, with the consent of the consumer, may provide him with an e-receipt, i.e. a fiscal receipt in electronic form. The possibility of issuing e-receipts is provided for taxpayers using virtual

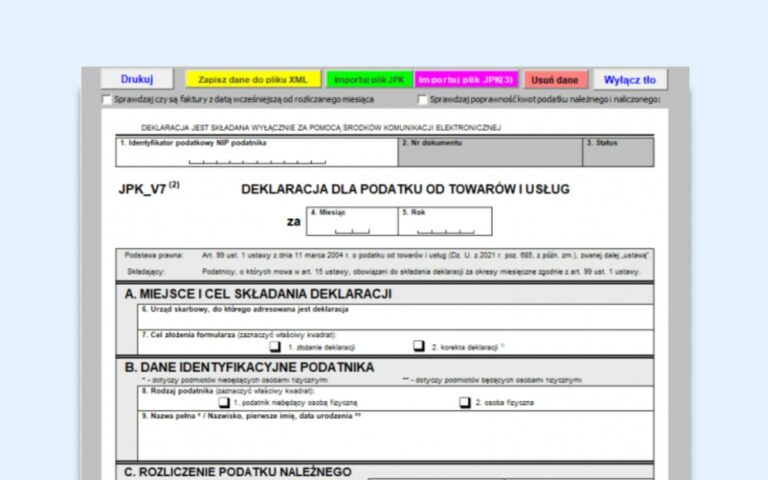

JPK VAT – everything you need to know!

JPK, i.e. the Uniform Control File, aims to improve the operation of tax authorities, as well as to standardize electronic data that entrepreneurs submit to the Tax Office. Although JPK initially covered only large companies, now it also applies to

Changes in labor law in 2023

In 2023, many changes will be made to the labor law. This is partly related to the implementation of the Directive of the European Parliament and of the EU Council on transparent and predictable working conditions in the European Union.

Extended deadline for 2022 Corporate Income Tax returns

According to the draft regulation, which was published on 16 February 2023 on the website of the Government Legislation Center and sent for consultation. The deadline for submitting the annual tax return (CIT-8, CIT-8AB) and payment of the tax due

What’s new in SLIM VAT 3?

SLIM VAT 3 is another package of solutions aimed at facilitating the VAT settlement for entrepreneurs. Proposed changes include simpler invoicing, reduced formalities and improved financial liquidity of companies. With these new solutions, running a company from the VAT settlement

The 8 most important changes in CIT in 2023

From 1 January 2023, the amended CIT regulations came into force. The following article includes the top 8 changes: Estonian CIT recognizing part of expenses, depreciation write-offs and write-offs for permanent loss of value related to the use of assets